PERSHING SQUARE’S WEEKLY QUESTIONS TO ADP

Since our first presentation on August 17, 2017, ADP has yet to respond to the substance of our arguments and it has effectively stated that it can’t do any better. Pershing Square has been publishing a series of weekly questions to ADP and asks that ADP answer these questions publicly and in a timely manner so that all investors may better evaluate the company’s performance and future prospects.

QUESTION 8:

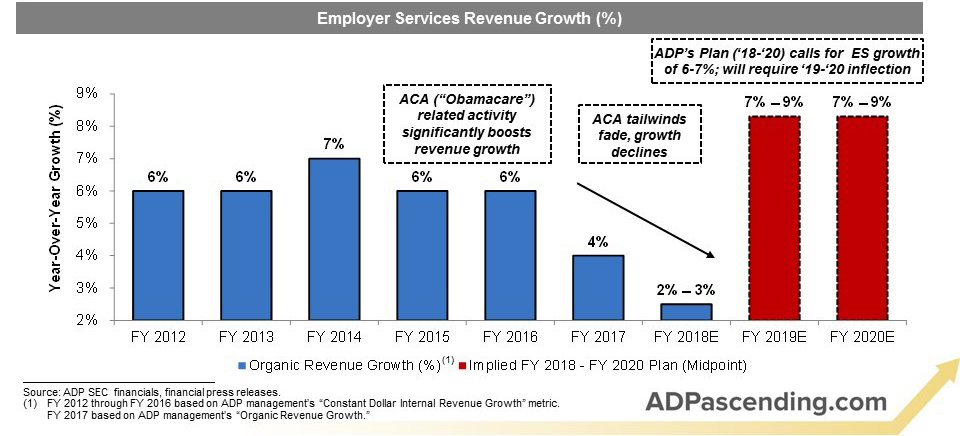

Despite a significant boost to growth from the implementation of the Affordable Care Act (“ACA”), ADP Employer Services’ growth remained constant at a ~6% organic growth rate in FY 2015 and 2016, suggesting an underlying deterioration (largely in Enterprise) which was masked by ACA tailwinds. As growth tailwinds from ACA have faded, growth has decelerated to low-single digits. ADP’s three-year plan released on September 12th implies Employer Services accelerating and achieving growth of 7-9% in FY ‘19 and FY ‘20. How will ADP achieve this significant acceleration in growth?

QUESTION 7:

We understand that ADP has commissioned various consulting studies over recent years which have outlined substantial efficiency opportunities. Please outline for shareholders the conclusions of these studies. What corporate inefficiencies did these studies address – including management spans and layers, real estate consolidation, and ADP’s siloed and outdated business unit structure – and what was the timing and the magnitude of the potential savings identified? Were these consulting studies shared with the Board?

QUESTIONS 5 + 6:

- Why does ADP continue to claim a 203% Total Shareholder Return (“TSR”) during Mr. Rodriguez’s tenure when this number includes an inaccurate start date, the increase in the stock price due to Pershing Square’s involvement, and the performance of CDK when it was no longer managed by Mr. Rodriguez?

- In recent shareholder communications, ADP is now claiming that it is implementing a plan to deliver 500bps of operational margin improvement. ADP’s recently released guidance shows only 100bps to 200bps of actual operating margin expansion by 2020 which compares with our estimated potential margin opportunity of 1,200bps by 2022.Investors cannot reconcile this 500bps calculation. Please provide support for this calculation and explain why these supposed savings do not translate into better operating margins.

QUESTION 4:

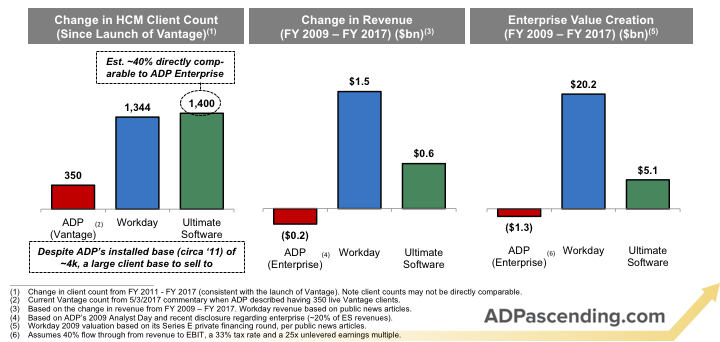

Competitors like Workday, Ultimate Software and Ceridian’s Dayforce have taken substantial market share at the expense of ADP, despite ADP spending significantly more on R&D. Why doesn’t ADP have a best-in-class product for the Enterprise market?

QUESTION 3:

Why is ADP’s labor productivity ~28% below its competitors’, particularly in light of its enormous scale advantage?

QUESTION 2:

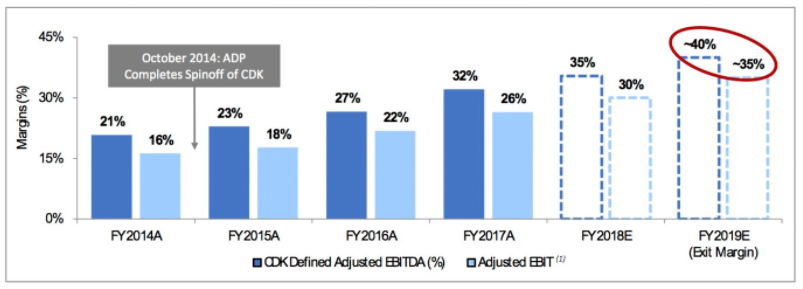

When ADP owned Dealer Services, it aimed to produce just ~50bps of annual margin improvement. When Dealer Services was spun-off as CDK Global (“CDK”), it promptly identified an opportunity to double margins without negative consequence to CDK’s customers, shareholders or other stakeholders. Why was

ADP not able to realize this opportunity when it owned CDK?

- CDK achieved this improvement by engaging constructively with shareholders, hiring an outside consultant to evaluate its potential, and announcing a transformation plan – why won’t ADP do the same?

CDK’s Margin Transformation

(1) Adjusted margins expensed stock-based compensation and D&A. 2014 EBIT adjusted to expense $16.8m of incremental costs associated with the formation of corporate departments as a stand-alone public company. These costs were incurred in fiscal 2016 and have been reflected as adjustments in fiscal 2014 to present these periods on a comparable basis.

QUESTION 1:

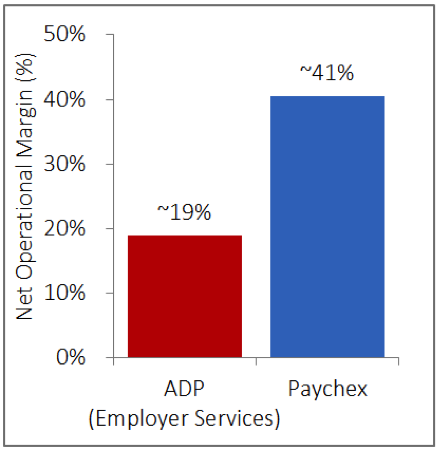

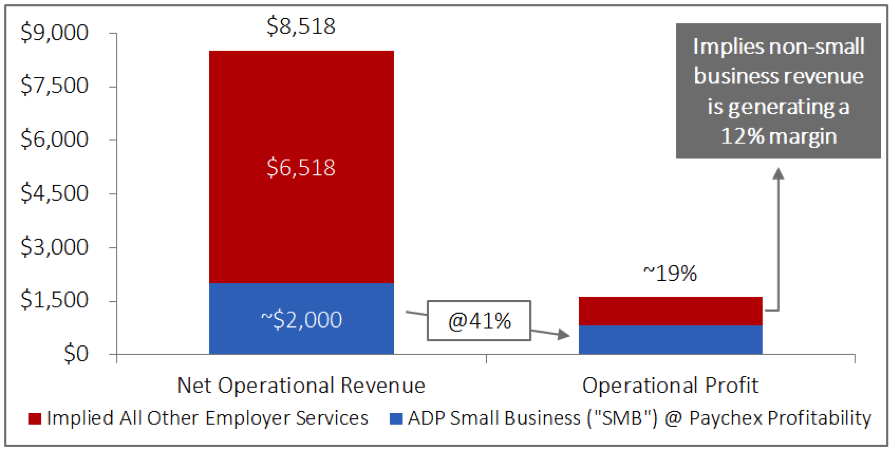

What are ADP’s margins in Employer Services by sub-segment (Small-Business (“SMB”), Mid-Market, Enterprise, and International), excluding float and allocating corporate expenses?

- Is ADP earning comparable margins to Paychex (~41%) in its SMB business? If so, that would imply 12% margins for the rest of Employer Services.

Sign up for email updates:

Contacts

Pershing Square

Fran McGill

212 909 2455

[email protected]

Rubenstein

Steve Murray

212 843 8293

[email protected]

Eric Kuo

212 843 8494

[email protected]